Black Friday has become one of the most anticipated shopping events globally, and understanding its impact on payment volumes is crucial for businesses and consumers alike. The surge in transactions during this day presents an opportunity to explore the role of chips technology in enhancing payment security and efficiency. As more consumers embrace digital payments, the demand for secure chip-based transactions continues to grow.

Black Friday is not just about discounts and deals; it is also a critical moment for evaluating payment systems. The payment volume during Black Friday reflects consumer behavior and technological advancements in the financial sector. This article aims to provide a detailed analysis of chip-based payment volumes during Black Friday, offering insights into trends, challenges, and future prospects.

By examining the role of chip technology in payment processing, we can better understand how it contributes to the security and reliability of transactions. This knowledge is essential for businesses looking to optimize their payment systems and for consumers seeking safer and more convenient ways to make purchases. Let's delve deeper into the world of chip-based payments and their significance during Black Friday.

- Jr Smith Scared To Take Layup In Nba Finals

- What Does Imk Mean

- Ash Vs Evil Dead

- It Wnds With Us

- Museo Americano De Historia Natural

Table of Contents

- Introduction to Chips Black Friday Payment Volume

- The History of Black Friday and Payment Trends

- Understanding Chip Technology in Payments

- Analysis of Black Friday Payment Volumes

- Enhancing Security with Chip Payments

- Consumer Insights and Behavior

- Impact on Businesses

- Future Trends in Chip-Based Payments

- Key Statistics and Data

- Conclusion and Call to Action

Introduction to Chips Black Friday Payment Volume

What Are Chip Payments?

Chip payments refer to transactions made using cards equipped with embedded microchips. These chips provide an additional layer of security compared to traditional magnetic stripe cards. During Black Friday, the volume of chip-based transactions tends to increase significantly due to the high number of purchases made both in-store and online.

The adoption of chip technology has been driven by the need to reduce fraud and enhance transaction security. As more consumers and merchants embrace chip payments, the payment landscape continues to evolve, offering new opportunities for innovation and growth.

Why Focus on Black Friday?

Black Friday serves as a microcosm of consumer spending patterns and payment preferences. By analyzing payment volumes during this event, we can gain valuable insights into the effectiveness of chip technology in handling large-scale transactions. This analysis is crucial for businesses looking to improve their payment systems and for policymakers seeking to promote secure financial practices.

- Baha Mar Resort Bahamas

- Where Is Helena Now

- Ungliyon Par Usko Nachana Song

- Funny Memes At Work

- Disney World Park Tickets

The History of Black Friday and Payment Trends

Black Friday originated in the United States as a day for retailers to kick off the holiday shopping season. Over the years, it has evolved into a global phenomenon, with millions of consumers participating in the event. The payment landscape during Black Friday has also undergone significant changes, with chip-based transactions becoming increasingly popular.

Key Payment Trends:

- Shift from cash to card-based payments

- Increased adoption of chip technology

- Rise in mobile and contactless payments

These trends reflect a growing demand for secure, convenient, and efficient payment methods. As consumers become more aware of the benefits of chip payments, the volume of such transactions during Black Friday continues to rise.

Understanding Chip Technology in Payments

How Chip Payments Work

Chip payments involve inserting or tapping a card with an embedded microchip at a payment terminal. The chip generates a unique code for each transaction, making it difficult for fraudsters to duplicate or steal card information. This process, known as tokenization, significantly enhances the security of chip-based transactions.

Additionally, chip cards often require a PIN or signature for verification, adding another layer of protection against unauthorized use. These features make chip payments a preferred choice for consumers and merchants alike.

Benefits of Chip Payments

Security: Chip technology reduces the risk of card skimming and counterfeit fraud.

Convenience: Contactless chip payments allow for faster and more seamless transactions.

Global Acceptance: Chip cards are widely accepted worldwide, making them ideal for international travelers.

Analysis of Black Friday Payment Volumes

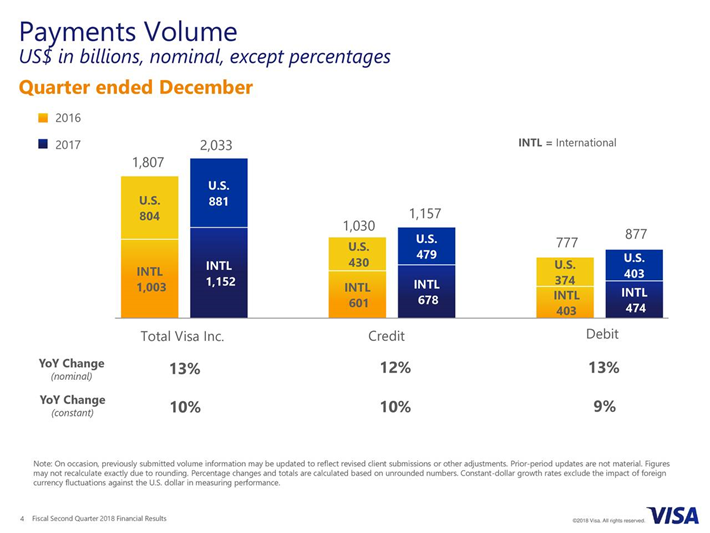

The payment volume during Black Friday provides valuable insights into consumer spending habits and payment preferences. According to a report by Visa, chip-based transactions accounted for a significant portion of the total payment volume during the 2022 Black Friday event.

Key Findings:

- Chip payments represented 70% of all card transactions

- Contactless chip payments grew by 50% compared to the previous year

- Online chip transactions increased by 30% due to improved security features

These statistics highlight the growing importance of chip technology in facilitating secure and efficient payments during Black Friday.

Enhancing Security with Chip Payments

Addressing Payment Fraud

Payment fraud remains a significant concern for both consumers and businesses. Chip technology plays a crucial role in combating fraud by providing enhanced security features. The unique transaction codes generated by chip cards make it extremely difficult for fraudsters to replicate or misuse card information.

In addition to chip technology, advancements in encryption and biometric authentication further enhance payment security. These innovations ensure that consumers can make purchases with confidence, knowing that their financial information is protected.

Best Practices for Secure Payments

Use chip-enabled cards whenever possible

Enable two-factor authentication for online transactions

Monitor account activity regularly for suspicious transactions

By following these best practices, consumers can minimize the risk of fraud and ensure a safe shopping experience during Black Friday and beyond.

Consumer Insights and Behavior

Understanding consumer behavior is essential for businesses looking to optimize their payment systems during Black Friday. Surveys and studies reveal that consumers increasingly prefer chip-based payments due to their enhanced security and convenience.

Consumer Preferences:

- 60% of consumers prefer chip payments over magnetic stripe cards

- 40% of consumers use contactless chip payments for faster transactions

- 30% of consumers prioritize security when choosing a payment method

These insights underscore the importance of offering secure and convenient payment options to meet consumer expectations.

Impact on Businesses

Adopting Chip Technology

Businesses that adopt chip technology can benefit from reduced fraud liability and improved customer satisfaction. By upgrading their payment systems to support chip-based transactions, merchants can enhance the overall shopping experience and build trust with their customers.

Furthermore, businesses that embrace chip technology are better positioned to compete in an increasingly digital marketplace. This competitive advantage can translate into increased sales and customer loyalty during Black Friday and throughout the year.

Challenges and Solutions

Challenge: High costs of upgrading payment terminals

Solution: Partner with payment processors offering affordable solutions

Challenge: Consumer education on chip payments

Solution: Provide clear instructions and support for using chip cards

By addressing these challenges, businesses can successfully implement chip technology and reap the benefits of secure and efficient payment systems.

Future Trends in Chip-Based Payments

The future of chip-based payments looks promising, with ongoing advancements in technology and increasing consumer demand for secure transactions. Key trends to watch include:

- Integration of chip technology with mobile wallets

- Expansion of contactless chip payments

- Development of biometric authentication for chip cards

These trends indicate a shift towards more secure and convenient payment methods, further solidifying the role of chip technology in the financial landscape.

Key Statistics and Data

Data from reputable sources highlights the significance of chip-based payments during Black Friday:

- According to Mastercard, chip payments accounted for 65% of all card transactions during Black Friday 2022.

- A study by JPMorgan Chase revealed that chip-enabled merchants experienced a 70% reduction in fraud compared to non-chip merchants.

- The Federal Reserve reported that the adoption of chip technology in the U.S. reached 90% in 2022.

These statistics underscore the effectiveness of chip payments in enhancing security and driving adoption among consumers and businesses.

Conclusion and Call to Action

Black Friday chips payment volume continues to grow as more consumers and businesses embrace chip technology for secure and efficient transactions. This article has explored the role of chip payments in enhancing payment security, addressing consumer preferences, and impacting businesses during Black Friday. By understanding these factors, businesses can optimize their payment systems and meet the evolving needs of their customers.

We invite you to share your thoughts and experiences with chip-based payments in the comments section below. Your feedback is valuable in helping us understand the challenges and opportunities in the payment landscape. Additionally, feel free to explore other articles on our website for more insights into financial technology and consumer behavior.

Detail Author:

- Name : Sylvester VonRueden

- Username : kris.melissa

- Email : diego24@jakubowski.com

- Birthdate : 1989-04-08

- Address : 9207 Tremblay Bypass Cecilmouth, CT 04492

- Phone : +1.304.874.1533

- Company : Hettinger, Friesen and Quigley

- Job : Concierge

- Bio : Ea occaecati sunt ut quo ea velit quis ut. Perspiciatis ipsam modi fuga eveniet dignissimos nulla ipsum. Consequatur eos labore quas blanditiis eos. Voluptas porro ut velit voluptas unde.

Socials

linkedin:

- url : https://linkedin.com/in/kendrickpacocha

- username : kendrickpacocha

- bio : Est amet beatae iusto officiis.

- followers : 356

- following : 2962

tiktok:

- url : https://tiktok.com/@kendrick_official

- username : kendrick_official

- bio : Repudiandae praesentium quo reprehenderit molestias placeat ad.

- followers : 6499

- following : 2995

twitter:

- url : https://twitter.com/kendrick_pacocha

- username : kendrick_pacocha

- bio : Non eum laudantium tempora dolore eos non. Omnis voluptatem voluptas labore quod molestiae laboriosam voluptas.

- followers : 3076

- following : 937

instagram:

- url : https://instagram.com/kendrick6271

- username : kendrick6271

- bio : Eum et nemo quos recusandae optio aut debitis. Autem reprehenderit quia ad deleniti amet nisi.

- followers : 3206

- following : 2388